What the NCAA Transfer Portal Teaches Healthcare RCM in 2026

Visibility drives strategy. Learn 5 NCAA portal lessons for 2026's Revenue Cycle: AI, leadership churn, vendor choice & how to adapt. Get clarity with RCR|HUB.

What the NCAA Transfer Portal Teaches Us About Revenue Cycle in 2026

As the college football transfer portal stays open through January 16, with an additional five-day window for teams playing in the national championship, thousands of athletes and hundreds of coaching staffs are navigating one of the most visible talent marketplaces in sports.

On the surface, the NCAA transfer portal appears chaotic. In reality, it is something far more important: a system of structured visibility, timing, and choice.

And in 2026, healthcare Revenue Cycle is experiencing the same shift.

Not because hospitals are suddenly acting like football teams, but because visibility and mobility now drive how decisions get made in both ecosystems.

How Big Is the Transfer Portal, Really?

In recent seasons, the NCAA football transfer portal has seen between 800 and 1,200 players enter each year across FBS and FCS programs. That means:

Nearly 10 percent of all Division I football players change programs annually

Hundreds of programs are actively recruiting from the portal

Entire rosters can shift in a single offseason

The portal didn’t create movement. It made movement visible.

That distinction matters.

The RCM Version of the Transfer Portal

Healthcare Revenue Cycle has its own version of this dynamic, just not in one place.

Across the U.S.:

There are 1,273+ active Revenue Cycle Business Partners (aka vendors) and technology providers (source rcrhub.com)

The market is growing at 11 to 12 percent annually

100+ new niche vendors enter the market every year, many focused-on AI, denials, patient financial engagement, or automation. “Two weeks ago, four new AI companies entered in one week,” noted Jena Eggert, RCR|HUB founder and CEO.

At the same time, the workforce is in motion:

The U.S. is creating an estimated 61,000 new healthcare management and revenue leadership roles per year

RCM leadership roles are projected to grow 23 percent by 2034

Hospitals are continuously replacing, expanding, or restructuring Revenue Cycle leadership teams

Just like college football, the players were always moving. The difference now is that movement is visible, trackable, and strategic.

The 2025–2026 Inflection Point: Leadership, AI, and the Knowledge Gap

In 2025, healthcare and Revenue Cycle organizations quietly crossed a major threshold. A large portion of experienced leaders began preparing for retirement or role transitions while AI-driven tools moved from pilot projects into daily operations.

This did not mean half the industry walked away. But it created real anxiety: how do you replace decades of institutional knowledge just as workflows are being rebuilt?

In 2026, this pressure is no longer theoretical. Organizations are now managing:

Veteran leaders are actually leaving

Younger managers are promoted faster than ever

AI-enabled platforms are reshaping prior auth, denials, and payment workflows

The result is not a dramatic collapse, but a steady, widespread churn that feels like a constant scramble to keep teams trained, aligned, and effective.

The old Revenue Cycle playbook was manual, driven by people who knew every payer nuance by heart. The new playbook is data-driven, automated, and continuously evolving.

The organizations poised to report a positive bottom line are those that treat training and enablement as strategic infrastructure, not an afterthought.

Team Size Matters: Football vs Revenue Cycle

To understand why this matters, look at a typical Division I football roster:

120 to 125 players

Offense, defense, and special teams

Specialists for every situation

Dozens of analysts, trainers, and coordinators behind the scenes

Now look at a large healthcare Revenue Cycle department:

Facility Type -Typical RCM Team Size:

Small Practice - 1 to 3 staff

Mid-Size Clinic - 5 to 15 staff

Large Hospital -50 to 150 staff

Health System - 150 to 300+ staff

A major health system’s Revenue Cycle operation is the size of a D1 football roster.

And yet:

Denial rates still sit around 10 to 12 percent

Patient balances keep rising

Staff burnout continues to increase

Just like football, having a big roster doesn’t mean you’re winning. You win when you have the right players, in the right roles, at the right time, and when you can fill the gaps fast.

What the Portal Actually Teaches Us

The NCAA transfer portal doesn’t teach us how to win games.

It teaches us how visibility changes behavior.

Five lessons apply directly to Revenue Cycle:

1. Visibility changes decision-making

When players enter the portal, every program can see them. When leadership changes are visible, our RCM is more informed and more intelligent.

That’s exactly why the Shakers & Movers page exists on the RCR|HUB website.

2. Timing creates leverage

The portal has windows. Enter early to get more options. Enter late, and you get what’s left.

RCM procurement works the same way:

Budget cycles

Contract renewals

Leadership onboarding

System replacements

Knowing when to move matters just as much as knowing what to choose.

3. Culture Fit beats brand

In football, highly ranked players often fail after transferring. Mid-tier players often thrive.

In Revenue Cycle, the same thing happens:

Bigger is not always the best fit

The most famous consultant isn’t always the right one

The right niche partner often delivers more impact

4. Depth wins championships

No team wins with stars alone. Special teams, analysts, and specialists decide games.

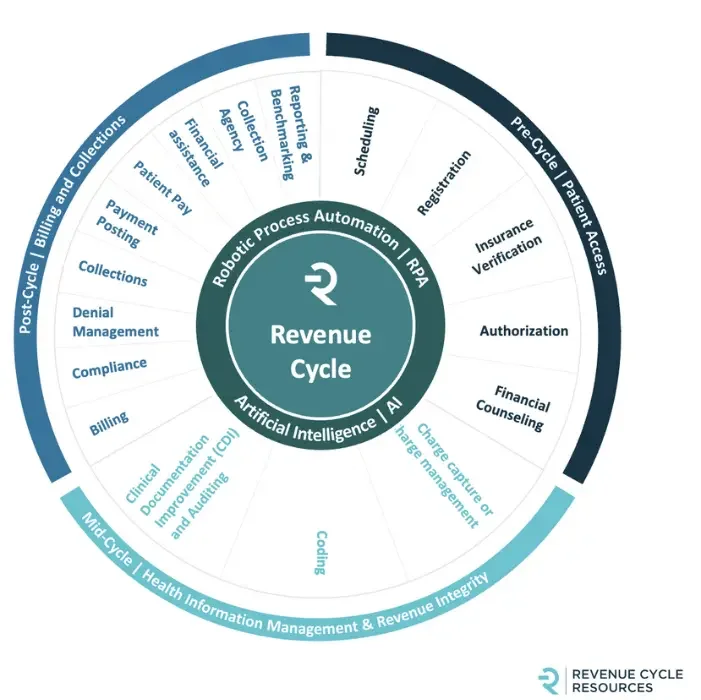

RCM is the same: From Scheduling to reporting and benchmarking, the ecosystem matters more than any single platform.

5. Movement is no longer failure

The portal removed the stigma from transferring.

In healthcare, creating new roles, eliminating old ones, and hiring new leaders can modernize workflows and are no longer seen as sources of instability; they are now seen as adaptations.

Where RCR|HUB Fits

RCR|HUB is a site that quiets the chaos, if only for a brief period. Connecting an RCM Community. How does that happen? With the help of a dedicated team of professionals and automation:

The HUB continues to track:

Provider leadership movement

95 RCM categories

RCM -RFP’s

Realtime Job Board

Realtime RCM Business Directory

Just like coaches watching the portal, Revenue Cycle leaders now have a way to see what is changing.

The Bottom Line

In 2026:

1,273+ RCM vendors

60,000+ new revenue leadership jobs each year

RCM teams the size of football rosters

Patient financial pressure rising

AI reshaping workflows

Movement isn’t chaos.

Movement is information.

And the teams that win in football and in Revenue Cycle are the ones that see the field clearly, understand timing, and build depth with purpose.

At RCR|HUB, that’s what we’re here to support.

There’s an app for that and a Community built to make it matter.