Post Discharge Insurance Discovery

-

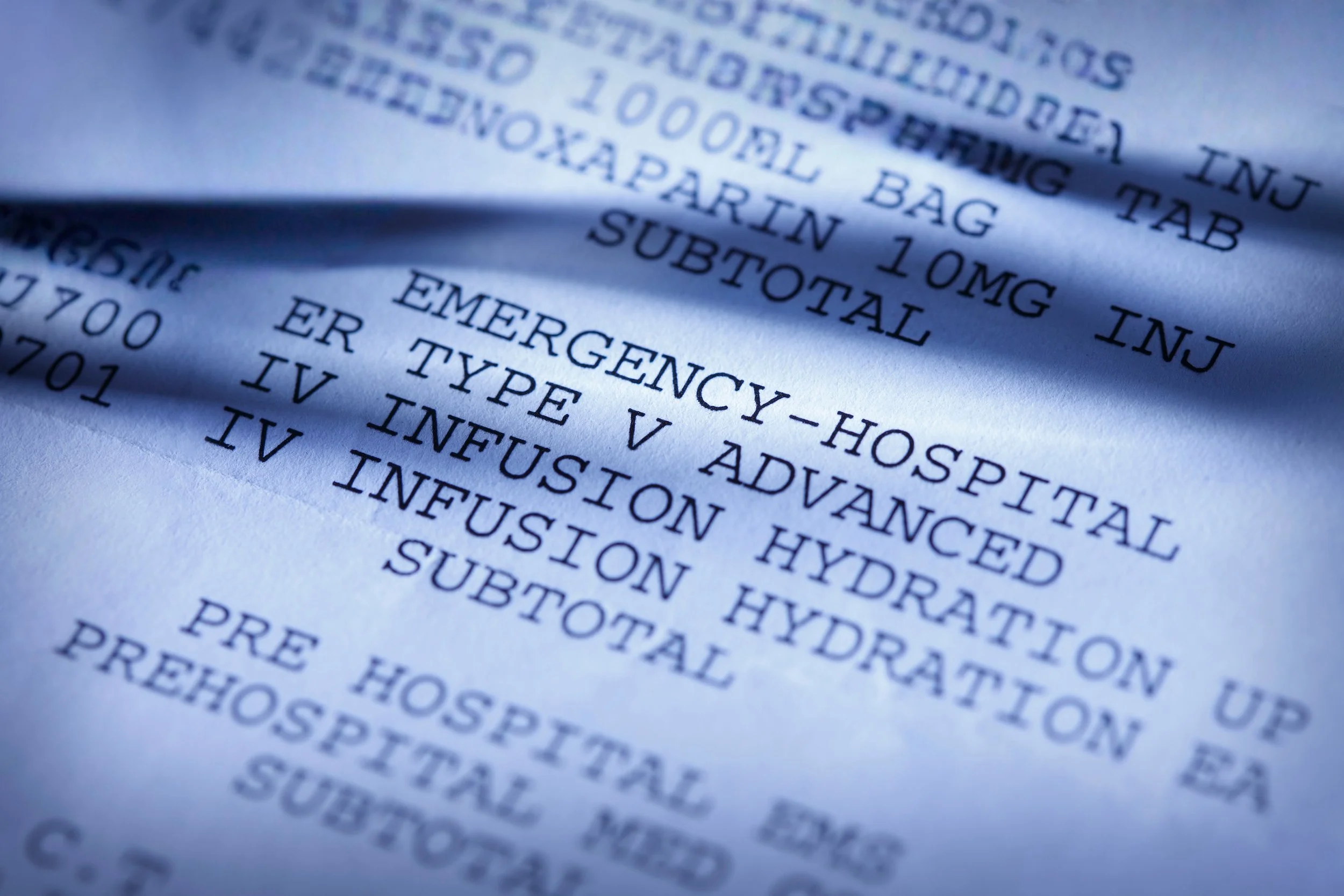

Post-discharge insurance discovery refers to the process of identifying and verifying a patient’s insurance coverage after they have been discharged, especially when insurance details were missing or unverified during the visit.

-

This can occur if the patient failed to provide insurance information, presented expired or incorrect details, or if there were changes in their coverage during or after their visit.

-

Healthcare providers use specialized software that accesses payer databases, insurance networks, and national data sources to match patient demographics and discover valid insurance coverage.

-

Once coverage is identified and eligibility is verified, claims are submitted to the appropriate payer. Accurate insurance data reduces denials and improves the speed and accuracy of reimbursement.

-

Yes, by identifying billable insurance coverage that would otherwise go unnoticed, post-discharge discovery significantly reduces write-offs and uncollectible accounts.

-

Patients are informed of any updated insurance coverage and how it impacts their financial responsibility, helping to avoid confusion or unexpected bills.

-

By automating insurance searches, verification, and claims workflows, this process minimizes manual work, enhances compliance, and accelerates revenue recovery.

Post Discharge Insurance Discovery

Post-discharge insurance discovery is a process in healthcare revenue cycle management (RCM) that involves identifying and verifying patients' insurance coverage after they have been discharged from a healthcare facility, such as a hospital. This process is critical for healthcare organizations to maximize revenue collection, reduce bad debt, and ensure accurate billing.

Top Post Discharge Insurance Discovery Business Partners List

Would you like your company to be added to the list?

List your company, website, and a brief description to be featured on RCR | HUB.

Want visibility in multiple categories?